Payroll tax penalty calculator

Your payment is 16. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related.

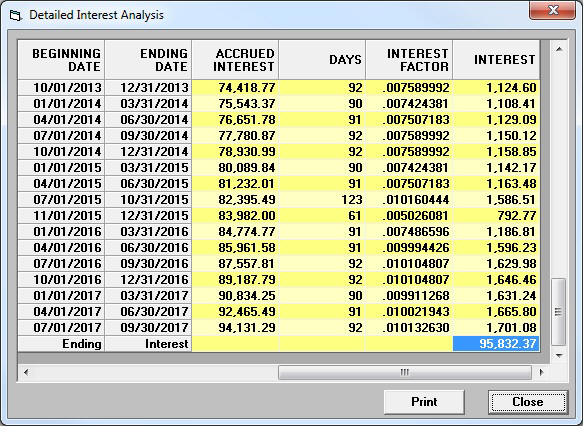

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

By using this site you agree to the use of cookies.

. Number of information returns slips filed. The maximum penalty is 25 of the additional taxes owed amount If both the failure-to-file and the failure-to-pay penalties are owed for the same month the failure-to-pay. The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late.

Ad Compare This Years Top 5 Free Payroll Software. Based Specialists Who Know You Your Business by Name. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Features That Benefit Every Business. PayrollPenalty calculates the lowest Failure To Deposit FTD penalty using IRS approved allocation methods IRC Code 6656 Rev. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

Employers deduct 62 of employee gross wages for Social Security until the wage base is reached and. When a taxpayer is charged with a penalty for both types of failures ie failure to file as well as failure to pay -the rate of. How to calculate payroll taxes.

Its quick and easy. Determine the cost of not paying up. PayrollPenalty uses up to 250 alternative methods of allocating deposits to give you the lowest possible penalty.

We calculate the Failure to File Penalty in this way. Now assume that you made estimated tax payments of only 2000. You or your client will.

Taxpayers who dont meet their tax obligations may owe a penalty. Your IRS Payroll Tax Penalty and Interest Solution. This is approximately 31 of your tax obligation 2000 divided by 6500 and it is less than your prior years income tax.

File your tax return on time. The penalty is 100 or the amount calculated according to the chart below whichever is more. After two months 5 of the.

This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations. Penalty is 5 of the total unpaid tax due for the first two months. For example if your deposit is more than 15 calendar days late we dont add a 10 penalty to the earlier 2 and 5 late penalties.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Discover ADP Payroll Benefits Insurance Time Talent HR More. The penalty wont exceed 25 of your unpaid taxes.

The IRS charges a penalty for various reasons including if you dont. We calculate the penalty on the unpaid amount from the due date of the estimated tax installment to the following dates whichever is earlier. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed.

Ad Take control of IRS payroll tax penalties and interest and prepare your IRS payroll forms. By using this site you agree to the use of cookies. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related.

Your payment is 1 to 5 days late. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Any failure to pay the correct amount of payroll tax. Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks.

Ad Process Payroll Faster Easier With ADP Payroll. Instantly Reduce the IRS Failure To Deposit Penalty. All Services Backed by Tax Guarantee.

2 of the amount due. Penalties under the relieving administrative policy. Instead in this example your new total penalty.

5 of the amount due. Get Started With ADP Payroll. Ad Payroll Made Easy.

The Payroll Tax Act 2007 the Act is a taxation law for the purposes of the Taxation Administration Act 1997 TAA. The date we receive your. The penalty wont exceed 25 of your unpaid taxes.

Your payment is 6 to 15 days late. The IRS charges a flat rate for payroll or FICA taxes. Interest is calculated by multiplying the unpaid tax owed by the current interest rate.

Failure To Deposit Penalty Calculator With Faqs Internal Revenue Code Simplified

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Failure To Deposit Penalty Calculator Tax Software Information

Filing Taxes Mistakes You Cannot Afford To Make Tax Relief Center Filing Taxes Tax Help Tax Mistakes

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

What Is Annual Income How To Calculate Your Salary

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free